Setting fire to the neighbours property, kids bouncing off jumping castles, cosmetics that burn your face off…. What the hell is a liability? Who the heck is a third party? Whatever happened to the second party? These and other conundrums solved in the first blog in a series that demystifies my world of liabilities.

A lot of people ask me what on earth a liability actually is? If you’re an accountant, too much liability is not a good thing. In the financial world a liability is the other side of the balance sheet; the dark and scary side that keeps you up at night. For many South Africans it’s the only side of the balance sheet unfortunately. Debts and sacks of money owed to other people often make up the bulk of financial liabilities.

By now you are thinking, “I knew this blog was going to be crap, if I wanted to be reminded of my financial woes I’d check my shares in a certain furniture and clothing retailer” I know you are thinking this because as I am writing it, I too am contemplating a much needed root-canal treatment rather than completing the blog.

Fortunately the type of liability that I am involved with, has nothing to do with accounting. Sorry bean-counters, there’s no ledger-porn to see here. I am the Liability Guy and welcome to the wondrous world of legal liability. This you’ll soon find out is much more exciting because it is here that we deal with:

- Killer cosmetic compounds that want nothing more than to give your customer that permanently surprised, “where are my eyebrows?” look.

- Erratic and irresponsible employees that light up more than a cigarette in your client’s warehouse whilst having a sneaky fag in the no-smoking area.

- Clumsy customers who fall down the stairs in your shop because they’re more into WhatsApp than watching where they are going. If you break it, you buy it doesn’t count when the damaged goods are your client’s legs.

- Sugar spiked toddles on a such a high in that play area at your restaurant that they bounce right off the jumping castle and straight into Mrs. Mathebula celebrating her 80thbirthday. Maybe that’s why they call them off-spring?

You may be wondering what all these ridiculously, tragic scenarios have in common? Well the truth is they will all probably result in a lawsuit against the owner of the business. There is of course insurance that can cover these events and the source of claims against these policies are generally those that have resulted in injury or damage sustained by a mysterious group of people we call, “third parties”.

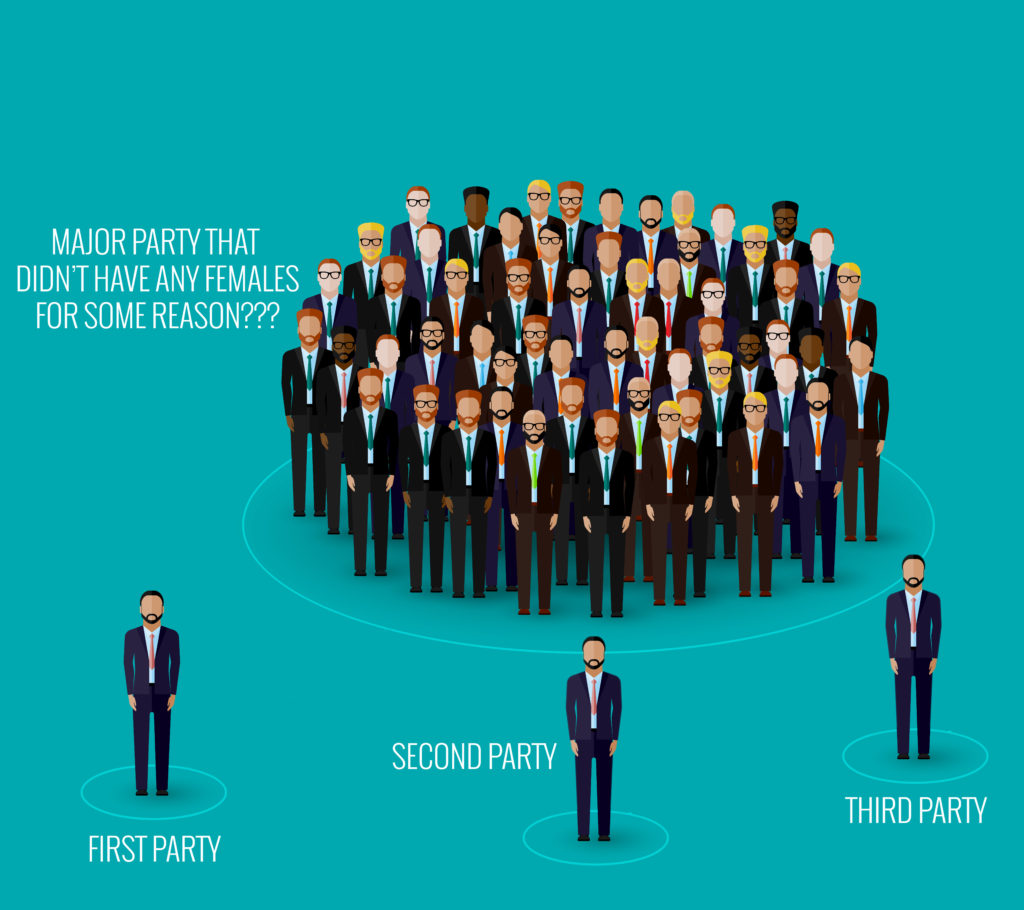

“A third party”, I see you raise both eyebrows. “I’m always up for a party, maybe even a second party but a third party? Will there be beer-pong, balloons, a cake or a cow on a spit? Three parties though. Who has that kind of staying power?” you may wonder.

Again, you’ve been misled, just like our accounting friends earlier in this article. The kind of third parties we talk about in liability insurance circles have nothing to do with people drinking and carrying on like teenagers, unless the business being sued is a bar. By the way, if you get drunk in a bar in some parts of the USA and cause an accident, the injured parties may actually sue the bartender for getting the driver drunk. True story, and similar things are on the cards in South Africa in proposed amendments to our own liquor laws. Did you see what I did with the word “parties” there?

The third parties we talk out in liability insurance are the hapless group of individuals (or even other businesses) who seem to have zero luck and are always on the receiving end of dangerous goods or poor services, inevitably leaving them out of pocket , injured or worse. We call them third parties because they are not a party to the insurance contract directly. The first party is the policyholder (the butcher, baker, candlestick maker or whomever had the foresight to buy the policy), the second party is generally accepted as the insurance company although you will never hear mention of the second party. We don’t ever talk about them. Are they are like the uncle who gets drunk at the family dinner and tries to get amorous with the garden gnome on the front lawn? Or are they the invisible heroes who want no credit for saving us from financial ruin? That I suppose depends on whether the claim gets paid…

In any event, this tale is not about the invisible second party. Just remember that the third party is the disgruntled, injured and often litigious individual who wants to take you to court. Unless you are a former president of a beautiful country at the tip of Africa, in which case a whole country may want to take you to court.

Don’t get me wrong, many third parties have good grounds for litigating and it is possible that the business actually did something to warrant being sued. Accidents do happen and someone is generally to blame when they do. If it’s not obvious whodunnit then both sides may have their day(s) in court. That’s generally where things get expensive and legal liabilities quickly start to turn into financial liabilities. Lawyers of the world rejoice. Accountants, you are back in play.

It’s these expensive processes in court and the fact that the business may have to compensate the injured third party that warrants buying liability insurance. This is also the primary reason why I have a job. So if you’re a broker, please sell more liability insurance.

Over the next few months I’ll be writing more about the wonders of liability so please be sure to follow this blog.

Note that as I am the LiabilityGuy I have to include a suitable disclaimer so please don’t treat any of these blogs as legal or financial advice. Be sure to chat to your broker if you’re a policyholder or if you’re a broker yourself, chat to your favourite insurance underwriter (follow my eyes) to get some detailed training or product information. The opinions expressed here are all my own, written in my personal capacity.

Related article on this blog : Coffee Cups, Ladders and Vibrators